Scandinavian places have emerged as major markets for IPTV adoption, with observing behaviors that reveal equally regional choices and worldwide leisure trends. Mathematical examination shows powerful habits across nordic iptv, and Denmark that highlight the region's innovative way of digital entertainment consumption.

Regional Use Costs Display Strong Development

Nordic places show excellent IPTV penetration costs in comparison to worldwide averages. Industry research suggests that 87% of Scandinavian homes now employ some type of IPTV service, considerably larger compared to the Western normal of 64%. That ownership spike represents a 52% increase over the past two years.

Sweden leads regional adoption with 91% family penetration, followed strongly by Norway at 89% and Denmark at 82%. These numbers reveal strong net infrastructure and high customer buying energy across the region.

Subscription growth prices remain consistently strong, with quarterly increases averaging 12% across all three countries. Towns show especially rapid adoption, while rural parts benefit from expanding fiber optic systems that help top quality streaming experiences.

Sports Material Dominates Watching Designs

Cold temperatures sports coding provides exemplary viewership figures throughout Scandinavia. Cross-country skiing, biathlon, and ice hockey account fully for 67% of all sports-related observing time all through maximum time months. Global games produce significant market spikes, with some activities reaching 94% house viewership.

Baseball remains common year-round, with both domestic league suits and international tournaments driving subscription decisions. Mathematical evaluation demonstrates football-related content influences 73% of new membership choices throughout the region.

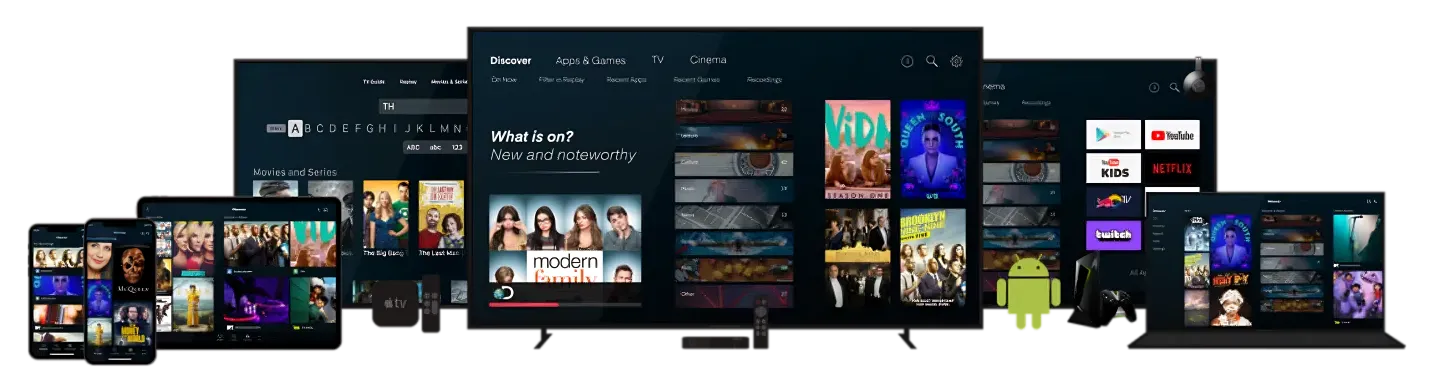

The flexibility of IPTV programs particularly appeals to Scandinavian visitors who follow multiple activities simultaneously. Multi-screen viewing raises by 340% during important sports, as readers track various games across different devices.

Leisure Preferences Reveal Cultural Prices

Documentary coding likes unusually high popularity compared to other American markets. Nature documentaries, famous material, and investigative journalism account fully for 31% of complete watching time, reflecting solid educational interests among Scandinavian audiences.

Crime drama line produce significant viewership, with Nordic noir productions reaching outstanding success equally domestically and internationally. Local crime series keep 89% completion prices among readers who start watching, showing extraordinary audience engagement.

Children's programming emphasizes instructional material over natural entertainment. Family seeing data demonstrate that 76% of children's coding involves educational components, supporting the region's concentrate on understanding and development.

Engineering Use Exceeds Worldwide Standards

4K content consumption charges in Scandinavia surpass global criteria significantly. Advanced quality watching accounts for 78% of all loading activity, in comparison to 45% globally. That preference reflects equally technological functions and customer readiness to purchase superior watching experiences.

Cloud-based documenting operation reaches 84% among members, with normal homes sustaining 15 hours of saved material simultaneously. That storage conduct indicates superior observing preparing and content management practices.

Portable watching represents 58% of full consumption time, highlighting the region's on-the-go lifestyle preferences. Tablet and smartphone application peaks throughout commuting hours and lunch pauses, demonstrating integration of activity in to daily routines.

Industry Revenue Developments Show Stability

Normal monthly membership fees in Scandinavia stay 23% more than Western averages, yet customer satisfaction results continually surpass 8.2 out of 10. This relationship suggests powerful observed price among customers despite advanced pricing structures.

Advanced deal adoption rates achieve 69% among customers, suggesting willingness to fund improved characteristics and content variety. Activities deals show especially powerful usage at 81% adoption among active subscribers.